By Akeem Awere

After about almost a week-long outrage and outcry against the directive of the Central Bank of Nigeria to levy a 0.5 percent cybersecurity charge on electronic transactions, President Bola Ahmed Tinubu finally bowed to the pressure of the Nigerian public and listened to the people’s voice. The President on May 11, according to the Punch Newspaper, ‘ordered the CBN to suspend the implementation of the controversial cybersecurity levy policy and ordered a review’. In what appeared like a departure from the administration’s characteristic uncompromising stance over some economic policies perceived widely to be harsh and insensitive, signs emerged that the Federal Government would budge after Members of the nation’s House of Representatives on Thursday, May 9th, 2024 asked the Central Bank of Nigeria to withdraw the circular directing financial institutions to commence implementation of the 0.5 percent cybersecurity levy, describing it as “ambiguous”. Be that as it may, the Federal Government deserves some commendation for suspending the directive and ordering a new review.

In a similar incident spotlighting this administration’s aggressive bid to generate revenue by raising taxation, a day after the House of Representatives requested the Federal Government to withdraw the obnoxious cybersecurity levy policy circular, news surfaced that the Federal Government plans to reintroduce telecom taxes and other fiscal policies to secure a $750 million loan from the World Bank. This is happening despite consistent protests by telecom operators about the challenges of doing business within the country coupled with over-taxation and unpredictable fiscal policy. Against this backdrop, telecom operators are also yearning for an increase in tariffs which they claimed has not increased since eleven years ago. Meanwhile, many observers have continued to criticize the government’s plan to reintroduce telecom taxes amidst its pain-inflicting revenue generation drive.

Speaking of revenue generation drive, governments across the world have the constitutional right and responsibility from their first day in office to generate revenue through various means including taxation. In the case of Nigeria, this particular right is enshrined in the 1999 Consitution currently in operation. There is a tendency, however, for a government at the cusp of financial catastrophe to become so desperate to achieve this objective. That being said, it is important to note that every responsible government is expected to be meticulous enough to avoid the mistake of overtaxing the economy it manages into a recession. To avoid falling into such a dilemma, it is expected that the government should diligently target more of those commodities whose demands remain obstinate in the face of price increases resulting from spikes in taxation. There might also be an urgent need to increase the taxes that are already levied on existing ones. In light of this, and against the background of the challenges of widespread addictive behaviours subsumed into an overwhelming national turpitude, intensifying the use of the Sin tax, also known as the Sumptuary tax or Vice tax seems to be a very viable solution.

A Sin tax (also known as a Sumptuary tax, or Vice tax) is an excise tax specifically levied on certain addictive goods deemed harmful to society and individuals. Traditionally, such commodities include alcohol, tobacco, non-medical marijuana and other narcotic substances, candies, soft drinks, fast foods, coffee, sugar, gambling, and pornography. The latest of these vices is Social Media addiction. Social media addiction is a behavioural addiction that is defined by being excessively concerned about social media, driven by an uncontrollable urge to log on to or use social media, and devoting so much time and effort to social media to the extent that it impairs other important life areas. As controversial as legalizing marijuana and taxing social media might seem, in its bid to expand its tax base and maximize its Internally Generated Revenue (IGR), social media and marijuana addictions provide the Nigerian government with a broad area of the potential tax base. Converting these vast areas into tax farms and responsibly harvesting them is a sure way of generating revenue without causing a backlash on the economy.

Beginning with marijuana legalization, I believe controlling the production of the substance species and decriminalizing it is long overdue in Nigeria. This will not only ease the government’s revenue generation drive but will also reduce the pressure of demand on our security and law enforcement resources. These resources are already stretched too thin. In democratic countries around the world, marijuana over the centuries has proven to be a substance that is highly resistant to laws enacted to abolish it. However, instead of expending a humongous part of our limited security resources to implement a total ban on a substance that also has a beneficial side, governments around the world have taken a rational decision to decriminalize the production and recreational use of certain species found not to have an adverse psychedelic effect on its users. The governments of the UK, Netherlands, South Africa, Malta, Thailand, Mexico, Uruguay, USA, Canada and others have since legalized the recreational use of the substance in their countries. In Nigeria, the stigmatization of marijuana users has significantly declined due to increased awareness about its therapeutic use as well as its recreational use across social lines. Students, Lawyers, judges, engineers, architects, law enforcement officers, politicians and many more responsible citizens make use of the substance without posing threats or dangers to society. If marijuana is eventually legalized in Nigeria, there is no doubt that the revenue to be generated from its taxation will in no distant time compete favourably with that derived from the taxation of alcohol and tobacco. To crown it all, the exportation of Medical Marijuana now serves as a source of foreign exchange earnings for some some countries, as a result, helping to improve the exporting countries’ balance of trade record. Lesotho, the first African country to legalize marijuana now exports Medical Marijuana to Canada, while countries like

Ghana, South Africa, Zambia, Zimbabwe and Swaziland are getting prepared to follow suit. For a country like Nigeria bedevilled with a twin problem – a perpetual slide in currency value and foreign exchange scarcity, exporting medical marijuana could be a major panacea for economic growth and development.

To avoid stepping on landmines, many thinkers cum analysts shy away from floating the idea of increasing taxes paid by internet users for the telecom data they fritter away on social media. This is because, over the years, Cyberspace has become an area known to be heavily monitored and guarded by rights and freedom activists all over the world for their fear of dictators stifling and taking over the space. However, with a purity of intent dictated by patriotic zeal, I am willing to go out on a limb regarding my stance, given the abusive and addictive use of the Internet via social media. I have no doubt that this problem is now a great source of concern to individuals, families and governments across the world. At times, one cannot just stop wondering how many Nigerian dependents and low-income earners idle away on social media watching videos with questionable entertainment value and devoid of educational benefit. This sizable population of netizens traverses Cyberspace by wandering from one social media site to another, hopping unproductively from WhatsApp to TikTok, from TikTok to Facebook, to Instagram, Twitter, Snapchat, and YouTube. As they gad these sites, they troll, bully, insult, spread unfounded rumours, dangerous fallacies, as well as conspiracy theories. Many of these social media users have as their role models on social media very queer and iconoclastic personalities who are of no positive influence on society. They can be heard privately complaining bitterly about the hardship imposed on them by the gruesome inflation. At the same time, they can also be seen on social media faking a hedonistic lifestyle that suggests affluence. Social media which was conceptualized as a veritable and user-centric digital technological tool for the purpose of facilitating social networking has been perverted by some users to become the number one source of distraction from meaningful productive engagements. It is undermining the cohesiveness of family units and driving individualism to the brink. It is one of the worst addictive behaviours of the twenty first century.

I unflinchingly believe that the Nigerian government can tax the sins of Nigerians into economic salvation by hiking taxes levied on telecom data without causing any harm to economy. The propensity of demand for telecom data to be irresponsive to price hikes is guaranteed by the people’s addiction to it.

Yet, on the contrary, some would argue that indiscriminately imposing a sin tax on social media is akin to meting out a blanket punishment on all netizens, the innocents and culprits inclusive. This argument in my opinion, is fair, sound and worthy of consideration. Unfortunately, however, I lack the professional competence to provide a foolproof technological solution that could usher in a regime of tax discrimination, but I am very confident that it is not an impracticable idea for the Information Technology experts. I believe that the profiling efficacy derived from the knowledge and experience of Psychographic Segmentation and Pricing Structure in the corporate world, can be adapted to provide a solution here.

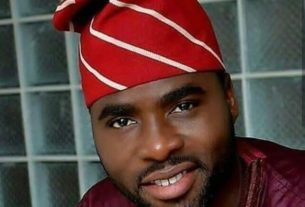

Akeem Awere is a news and current affairs analyst.